Guide for launching a profitable business

In order to start a business, it is not only necessary to be financially ready, you must also analyze which business lines are most likely to generate profits, or rather, how you should manage your company to make it profitable.

The available information almost always suggests that the profitability of a business is achievable only when the investment is small. But this issue is a bit more complicated and you should rather plan as detailed as possible.

This is why here we will explain all the basic concepts so that, before starting a business (or if you already have a business in its early stages), you have the basic tools to achieve the goal of all businesses: profitability.

What is a profitable business?

Profitable businesses are those whose profits (or revenues) exceed their cost of sales and administrative expenses. This is measured through an income statement (also known as a profit and loss statement).

It seems very simple, however you have to know how to categorize the costs and how to do the corresponding operations to determine if your business is profitable or if you are losing money. This way, once you use this tool you will have more accurate information to know how much profit is generated.

Keep in mind that at the beginning you will have more expenses than income. But with a sales projection, dissemination strategies and a constant monitoring of costs and revenues, the probabilities of generating profits will increase.

How to know if your business is profitable?

Profitability is not something that is only determined by the initial investment. As previously mentioned, this is something that you have to measure through an income statement where sales, taxes and other expenses are considered and which we will explain later. So, technically, profitability is something that can only be measured by businesses that are already operating.

Don't panic, if you are still in the decision stage, you should analyze the feasibility of a business idea.

From 2014 to 2019 INEGI National Statistical Directory of Economic Units (DENUE) released that the number of businesses increased 10.6%.

The total number of establishments as of November 2019 amounted up to 5 million 447 thousand 591 establishments in all sectors. This means that from one census to the other there was a 10.6% growth in the number of establishments.

How to know if your business idea is feasible?

If your business operations have not yet started, maybe what you are looking to know is: if your company is going to be feasible. To do so, you will need to establish a business plan where you should contemplate: how you will finance the first expenses, how much you need to sell, to whom you need to sell, what your value offer will be, etc.

4 points to determine the feasibility of your business

We have prepared a short summary with some points that may be useful for your business planning:

- Who will be your clients: Who are your ideal clients? What do they like to do? How do they shop? How do they prefer to pay? What is their lifestyle like? What are their biggest frustrations? The answers to these questions will help you not only to adjust the details of your products or services, they will also help you to get an idea of demand and thus help you to tailor your digital strategy.

- Figure out your financial plan: Do you know how much it will cost to start your business? How much do you need to sell to cover expenses and to make a profit? These are basic questions that will help you create a financial forecast. The point is that you detail all expenses and set sales targets.

- Who will be your competitors: Once you know the characteristics of your customers, you should create a list of competitors that address the same niche as you. To complement this point, you can also perform a Strengths and Weaknesses Analysis (SWOT) of the competitors.

- What value will you add: For your business to be profitable you must not only consider attracting customers, you must also plan how you are going to retain them. This can be achieved by analyzing how you can provide a better experience and/or how you can create value in the lives of the people who buy from you.

The most profitable businesses in Mexico

- Food and beverage preparation

- Small scale retailing

- Beauty salons and clinics

We did a research with figures published by INEGI with the business lines that generate more income and employment in Mexico, since companies that generate more work tend to have higher profits and be more sustainable.

Food and beverage preparation

Mexican Restaurant Industry Association figures show that there are 555,022 establishments dedicated to the preparation of food and beverages, of which more than 90% are micro-businesses such as lunch counters, snack bars, coffee shops, etc. The same institution also states that the estimated value of the restaurant industry is 300 million pesos, which is equivalent to 2% of the national Gross Domestic Product (GDP) and represents 14% of the tourism sector's GDP. In terms of job creation, this line of business occupies the first position with the highest share of employment since the 2014 INEGI economic census.

Betting in food trends may be the key to your positioning:

This is indeed a sector that generates a lot of revenue, but it is also a very competitive field. So the key, for this type of business, is to bet on innovation with a view to improving the food system or focusing on the customer experience. So one possible angle, to generate a profitable proposition, is to take a look at the trends that sites like the New York Times and Travel Market Report have listed in recent publications:

- Alternative diets: gluten-free, keto, vegan, dairy-free, etc.

- Healthy ingredients: biodiversity in the menu, including tubers, seeds, root vegetables, sprouts and seaweed.

- Restaurants with purpose: that strengthen local communities and producers.

- Cocktails: customized, low alcohol or alcohol with denomination of origin (mezcal), or with botanical ingredients.

Bonus: Why does trends point to plant-based foods and purpose-driven restaurants?

According to the study "50 Foods for Healthy People and a Healthier Planet" by Knorr, there is little diversity in the food consumed globally, with 75% of the world's food supply coming from 12 plants and 5 animal species.

On the same point, the New York Times in its article "What will we eat in 2020? Something Toasty, Something Blue" noted that the cause of the year is to save the planet, as both producers and consumers are increasingly concerned about the environmental impact of what they eat. Consequently, restaurants and food producers are doubling down on eco-friendly ingredients and practices.

Small scale retailing

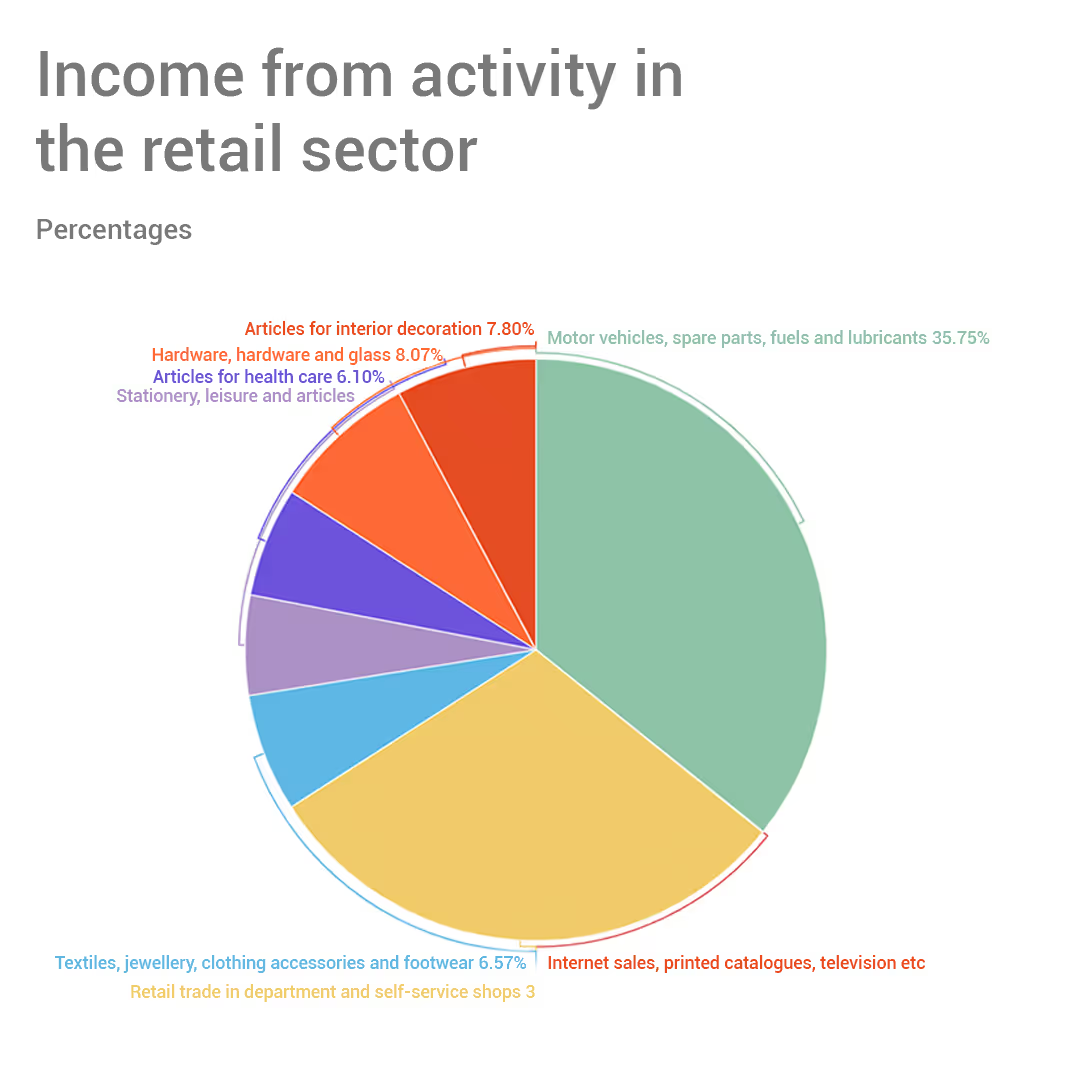

Revenues by activity in the small scale retailing sector

This sector comprises companies dedicated mainly to the purchase and sale (without transformation) of goods for personal or household use, as well as products that are also marketed from business to business, such as the trade of spare parts or lubricating oils for automobiles. In Mexico, this sector is of utmost importance as it represents approximately 9.2% of the economy, according to the research collective "México, cómo vamos" (Mexico, how we are doing).

It should be noted that these companies increased their real revenues 1.8% during 2019, as observed by INEGI.

In this sector, the most important revenue-generating activities are:

- Sale of motor vehicles, spare parts, fuels and lubricants.

- Self-service and department stores.

- Groceries, food, beverages, ice and tobacco.

Of course, this category is huge and in the above graph we can see how commercial activities related to the sale of stationery, health care items, decorations and textile products are also positioned.

Beauty salons and clinics

Another profitable business is the beauty industry services, those that offer services such as: cuts, shaving, tanning, massage centers and beauty clinics.

Beauty clinics are a category that even stands out worldwide, as according to the International Society for Aesthetic Plastic Surgery, in 2016 Mexico ranked 7th place worldwide in the highest number of non-surgical treatments.

Some treatments that can be implemented are hair removal, anti-cellulite treatments or anti-aging facial treatments.

Nationally, according to the research agency Market Data, there are 190,000 establishments in the country, generating approximately $35 billion in revenues. Most businesses are established in the State of Mexico, followed by Mexico City and in third place is the state of Jalisco.

Businesses by regional vocation

Remember, this is a list based on the general average made by INEGI, each region has different results. For example, Chihuahua, Coahuila, Baja California, Tamaulipas, Aguascalientes, Guanajuato, Tlaxcala, Querétaro, San Luis Potosí and Nuevo León are states with a manufacturing vocation. This means that in these states the most profitable businesses are those related to the manufacture of bread and tortilla products, plastics, electronic components, beverage industries, clothing manufacturing, furniture manufacturing, etc.

How to measure the profitability of your business

It is through an income statement and therefore this document is vital to know the financial health of a business.

But most entrepreneurs do not have legal or accounting advice at the beginning of their operations. In fact, in 2013 the consulting firm Salles Sainz Gran Thornton noted that this was the case with 7 out of 10 businesses in Mexico.

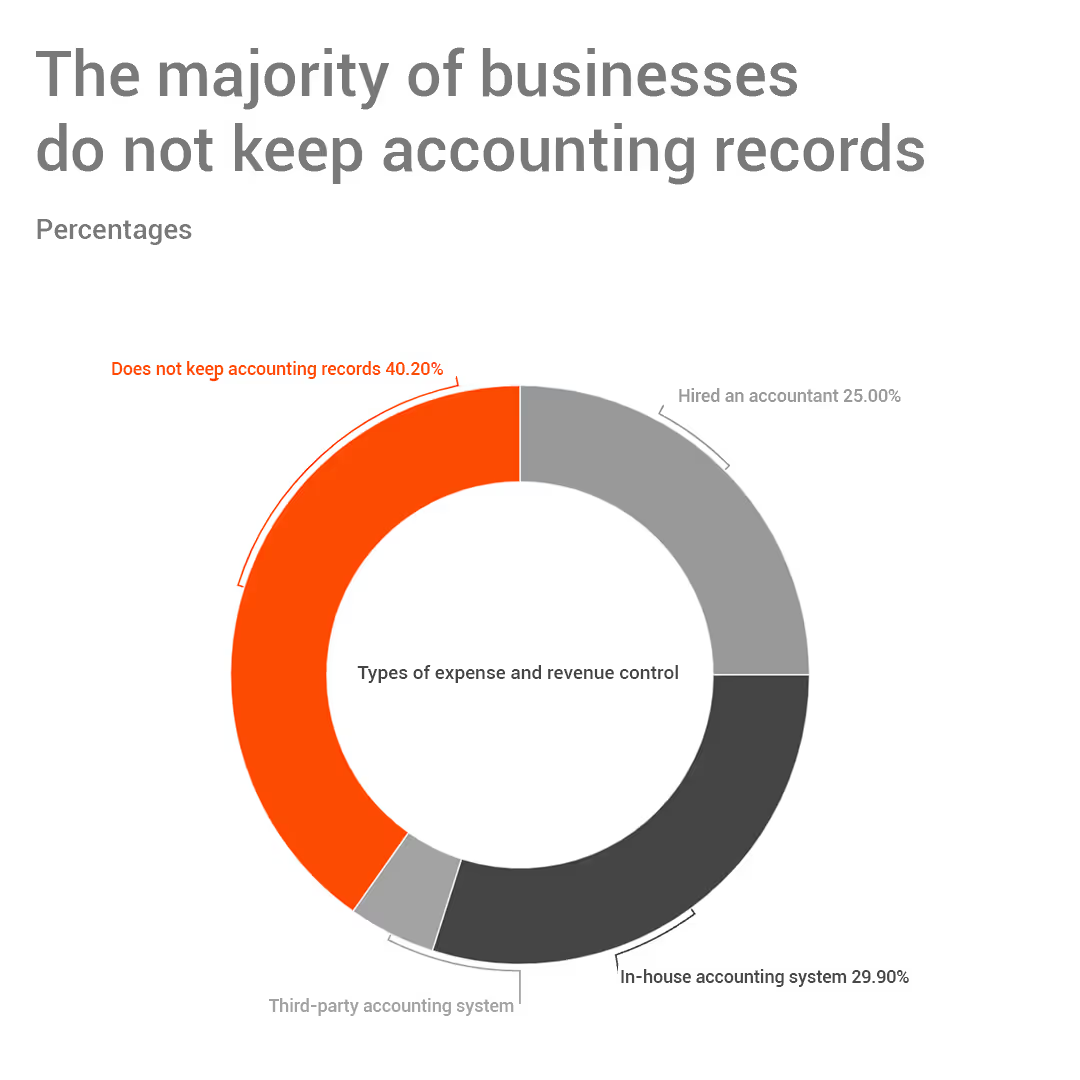

The majority of businesses do not keep accounting records

This problem is still an unfortunate trend as INEGI's 2019 Economic Census highlighted that 40.2% of establishments in Mexico do not keep accounting records. This is a very high risk for businesses as entrepreneurs do not know how to manage themselves or how much tax they have to pay.

This is something that severely affects entrepreneurs and is probably one of the factors why 75% of businesses do not survive their first two years of life, according to the Center for the Development of Entrepreneurial Competitiveness.

We know that, at first approach, financial or accounting issues may seem intimidating or very complex, but we list the benefits and a brief tutorial to guide you through the basics.

Benefits of keeping accounting records:

- You know how much it costs to produce an item to determine prices.

- It allows you to divide the personal expenses of the entrepreneurs with those of the business.

- It helps you to know in a timely manner if there are losses or profits.

- It facilitates the control and adjustment of expenses.

- By knowing the economic situation of a business, it is easier to get advice or loans.

- It indicates to the entrepreneurs if it is time to reinvest in the business for growth..

What is a profit and loss statement?

Profitability is measured with an "profit and loss statement". This is one of the basic financial concepts you need to master in order to manage your business. It is a document (usually in spreadsheet format) that indicates how much a business has lost or earned. It essentially consists of different line items:

- Sales: This is all the income from your business.

- Cost of sales: This item includes the cost of raw materials and labor.

- Expenses: Within this component there are three important items:

- Administrative: These are the services such as telephone, electricity or internet plus the salaries of the personnel that attends or manages the business.

- Selling: This refers to the expenses for advertising or any other action you take to sell.

- Financial: This only applies if your business has borrowed money from a financial institution.

- Taxes: This is what you must pay in taxes to the SAT upon profit.

Important: Do not confuse the salaries of your business personnel with labor costs. For example: If your business is a furniture store, labor is what you pay the craftsmen or carpenters who make the furniture. Staff salaries are your business accountant or salespeople in the store.

How to make a profit and loss statement in three steps:

- Calculate your gross sales.

- Calculate your sales cost and gross profit.

- Obtain the profit before and after taxes.

Now that you know what a profit and loss statement is and what are the items of such statement, we will explain how to prepare this document. The objective is that you have a tutorial so that you have a basic accounting record or if you decide to hire an accountant it will be easier for you to understand the documents that he/she prepares for your business.

Before starting with step by step breakdown, it is necessary that all files have the name of your company and the period of time you are considering. It is also recommended that you have a percentage column where 100% is the total number of sales. This way it will be much easier to analyze how the money is flowing in your business and if you need to make any adjustments.

Step 1: Calculate your gross sales

Let's go back to the furniture store example. In the month of January, you sold 100 thousand pesos, but you had many promotions to free up your inventory and 5 thousand pesos were deducted from the total sales. To get the gross sales, you must subtract those 5 thousand pesos of discounts on sales from the 100 thousand pesos of sales. So according to this example, the gross sales will be 95 thousand pesos.

Step 2: Calculate sales costs and gross profit

To obtain the gross profit number, you must first know the total sales cost. To do this, add the labor and raw material items together.

To continue with the example, take into account labor costs are 50 thousand and raw material costs are 20 thousand. This means that the cost of sales is 70 thousand (i.e. 70% of your total sales). We know this may seem like a large sum but in most businesses the cost of sales exceeds 50%.

Now, to obtain the gross profit subtract the 70 thousand of sales costs from the 95 thousand of gross sales that you took out previously. Consequently, the gross profit will be 25 thousand.

Step 3: Obtain profit before and after taxes

Your furniture store spent 15 thousand pesos of (administrative expenses, salaries and services) and 2 thousand pesos of selling expenses (i.e., advertising expenses), so the total expenses are 17 thousand pesos. Subsequently, the total expenses amount must be subtracted from the gross profit amount. With this you will obtain the profit before taxes.

There are many types of taxes, but the only one that is considered in the profit and loss statement is the income tax. To obtain the final result you only have to subtract 30% (the common tax percentage in Mexico) from the number of profit before taxes.

Why create a business formally

In the previous point we mentioned the issue of taxes because we recommend that businesses start from formality. We know that this is something that scares many entrepreneurs because they feel that by doing so, much of their profits go to pay taxes and permits. But formality brings with it benefits such as:

- Generate greater customer confidence: Your current and potential customers are looking for all kinds of guarantees to make their purchase, so they will probably buy products and services with legally constituted businesses.

- Access to credit and government support: Formality allows you to have access to financial products, private or government, designed for micro-businesses and SMEs. This in turn mitigates taxes because they are tax deductible.

Avoid severe penalties: Paying taxes is something that bothers many entrepreneurs but it is much worse when this is not done, as the penalties can be so severe that they unbalance businesses financially.

Step by step: How to start a business

Any entrepreneur will quickly learn that starting a business requires a lot of work. Not only is it not enough to analyze feasibility or develop financial projections, sometimes the biggest challenge is getting everything off the ground because many entrepreneurs may not be familiar with the steps involved to formally launch a business:

- Have your e.firma ready: You will need this file for the following steps. If you do not have your e.firma yet, you only need to schedule your appointment at the SAT and show up with a USB memory stick, an email address, CURP and your INE.

- Request your company name authorization at the Ministry of Economy: One of the functions of this institution is to approve or reject names, i.e. the name or company name, with which you want to create the company. This procedure is free and can be done online with your e.firma. For this step we recommend requesting 3 to 5 different names to increase the probabilities of authorization

- Incorporate your company as a SAS: Now it is no longer necessary for businesses to draft their Articles of Incorporation and validate them before a notary public. If it is an SME, it is best to incorporate as a Simplified Joint Stock Company. Just take into account that if you decide to incorporate under this figure: the annual income of the business must not exceed 5 million pesos and in no case the shareholders may be shareholders with decision-making power in another type of corporation.

- Obtain your Taxpayer Identification Number (RFC): the application process to register your company's RFC must be done at the SAT offices in the locality where the company is incorporated.

Registration with the IMSS: Even if the only workers are the partners, you must go to the IMSS to request the registration of your business so that your personal contributions and those of the future employees of the company can be made. You can pre-fill out the form and then go to the corresponding subdelegation.

Why small businesses should bet on technology to achieve profitability

SMEs in Mexico represent 95% of businesses in Mexico. Consequently, this drives the economy and employment generation in the country. But as previously mentioned, the vast majority of the businesses that are created fail to survive their first 2 years.

Some of the difficulties faced by these businesses are:

- Insecurity

- High utility costs (water, electricity, telephone, etc.)

- Unfair competition

- Low demand for their goods

- High raw material costs

- Lack of credit

Online sales:

Several of the difficulties mentioned in the previous paragraph can be counteracted with the use of technology, but this is something that is not yet a trend in the entrepreneurial sector.

According to INEGI, only 4.3% of entrepreneurs used the Internet for their purchases or sales.

Social networks:

Social networks are an important sales channel for SMEs. In the case of Facebook, the consulting firm Morning Consult conducted a survey that revealed that 68% of micro-businesses that have a presence on this platform increased their sales.

Other apps to sell and manage your business:

In this sense, we recommend the use of technology not only to sell or buy, but also to promote your products digitally, keep track of inventories, optimize logistics systems, or include other payment methods, just to mention a few.

Therefore, technology will allow you to be innovative while generating significant savings and improving your productivity. Consequently, you will boost profitability and extend the life of your company.

In conclusion

We hope that the figures provided throughout this guide will be useful to you. A profitable business can be achieved from formality with a lot of planning, analysis and monitoring. It is not an easy task, but with the right tools it is easier to get good results.

As a leading fintech company, we are frequently under the spot.

Go to Clip in the news*Spanish content only

By clicking Subscribe you're confirming that you agree with our Global Policy.

Explore our current positions. Your next job could be around the corner.

Go to careers

.avif)